Where Real World Value goes on chain.

The Tokenization PaaS for ETF Issuers

AndrA is a white-label platform that enables ETF issuers to launch digital share classes, unlock global distribution, and move settlement on-chain — with regulatory-grade privacy and compliance

WHY TOKENIZE ETFs?

ETF Infrastructure is Ready for Transformation

Despite decades of innovation in financial markets, ETF operations still rely on slow, fragmented systems.

- T+2 settlement cycles lock capital for days

- Opaque workflows create operational risk

- Jurisdictional complexity slows distribution

- Global access is limited to a few capital markets

- Fractional ownership is not native

Tokenization fixes these constraints at the protocol layer — making ETFs faster, more accessible, and more efficient to operate at scale.

T+0 Settlement Efficiency

Launch your own branded digital share class, enabling fractional ownership and global investor access.

Automated Compliance

KYC, AML, and jurisdictional rules are embedded directly into the token architecture, ensuring perpetual compliance on every transfer.

Beautiful website with modern UI / UX

AndrA delivers a beautifully designed platform with modern UI/UX, making tokenization clear, intuitive, and effortless—so anyone can navigate, manage, and scale digital assets with confidence.

White-Label Distribution

Move ETF settlement from days to seconds, eliminating counterparty risk and freeing capital previously locked in T+2 cycles.

WHY CANTON?

Institutional-Grade Infrastructure

Andra is built on the Canton network the first privacy-preserving smart contract network purpose-built for regulated finance.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Why this matters:

- Regulatory-grade privacy for investor and NAV data

- No mempool — zero frontrunning risk

- Deterministic execution for settlement certainty

- Synchronized interoperability across asset domains

- Bank-grade architecture securing every transaction.

- Used by leading global institutions

Traditional public blockchains cannot provide the privacy, compliance enforcement, or jurisdictional control required for regulated ETFs. Canton can.art contract network purpose-built for regulated finance.

ANDRA’S COMPETITIVE ADVANTAGE

Purpose-Built for ETF Issuers

Where other tokenization solutions generalize across asset classes, Andra focuses on one segment: regulated ETFs.

In this space, expertise, compliance, and speed to market matter more than raw technology—this is where Andra’s moat lives.

This focus creates a durable moat in a market where expertise, compliance, and time-to-market matter more than technology alone.

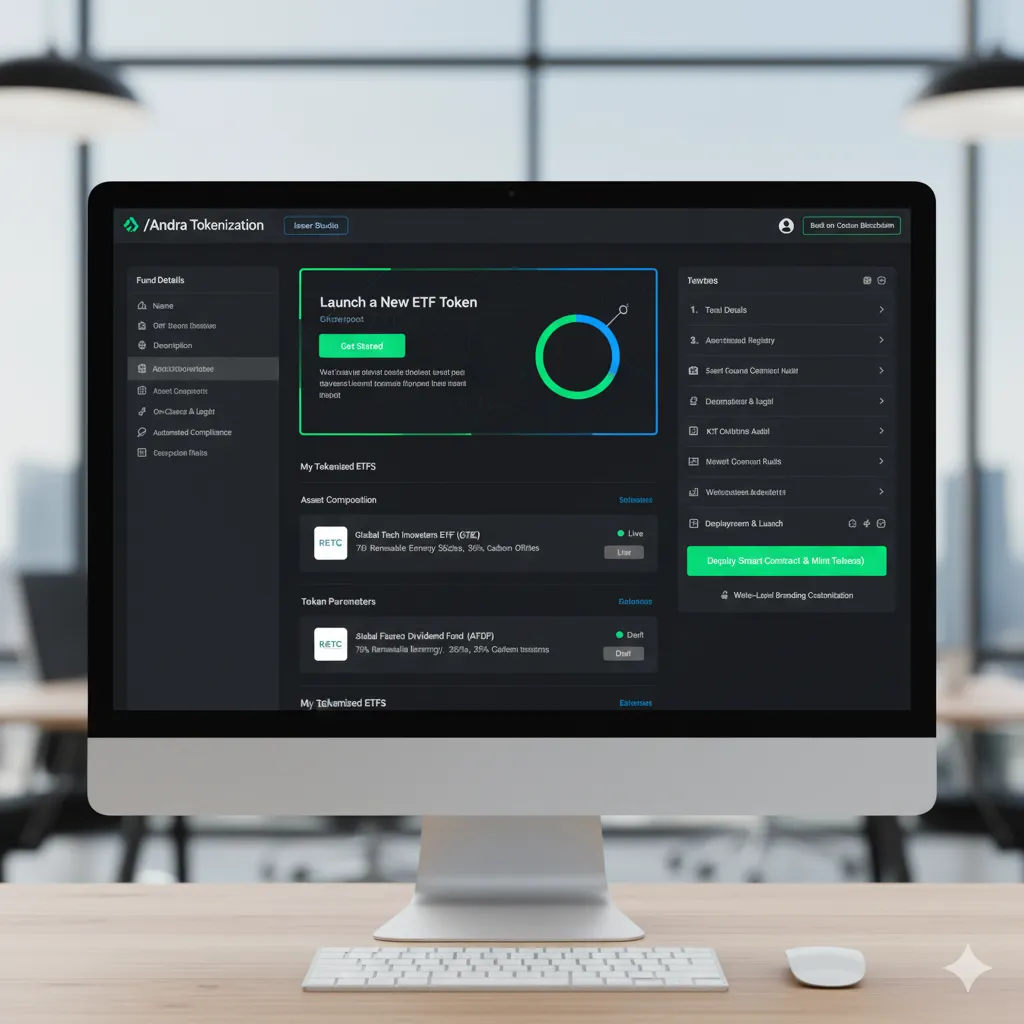

What Does AndrA do?

Powering the Next Generation of ETF Distribution

The Andra platform is a full-stack infrastructure layer for tokenized asset management.

What you get:

- Smart contract architecture for ETF share classes

- Custody & broker-dealer integrations

- Investor KYC/AML enforcement

- Issuer admin dashboard

- Real-time NAV transparency

- Audit-ready transaction records

- Global distribution controls

- Domain-level scale on Canton

As a white-label solution, AndrA handles the blockchain complexity so issuers can focus entirely on fund management and AUM growth.

7RCC

The 7RCC Showcase

As a 7RCC company, Andra has an anchor client and a live path to market from Day 1.

- Anchor Client: Immediate tokenization of 7RCC’s flagship ETFs

- Showcase Asset: 7RCC BTCK ETF — Bitcoin + Carbon Credit Futures

- Market Validation: Proven ability to handle complex, regulated assets

- Launch: Upon S-1 effectiveness and NYSE listings

The showcase ETF demonstrates the entire lifecycle of a tokenized ETF from creation to digital share class distribution.

Collaboration & support

The $18.8T ETF Market is Going Digital

Tokenization is expected to capture $16 trillion in assets by 2030 (BCG).

Capturing even 0.5% of new ETF launches translates into massive AUM on the platform and recurring revenue for issuers.

Andra is the technology backbone enabling this transformation providing the rails for secure, compliant, on-chain ETF distribution.

COMPLIANCE

Compliance at the Protocol Layer

Andra embeds regulatory logic directly into the asset itself.

Built-in controls include:

- Identity enforcement

No transfers without validated KYC/AML - Jurisdiction rules

Regional restrictions automatically enforced - Ownership logic

Institutional vs retail treatment - Sanctions screening

24/7 automated checks - Transfer agent rules

Compliance even in peer-to-peer movement

This allows perpetual compliance without manual intervention significantly reducing risk for issuers.

Everything You Need to Tokenize an ETF

The Andra platform provides all layers of the stack required to launch a tokenized ETF from smart contract architecture to custody integration and investor onboarding. Andra supports multiple institutional use cases:

RIA & Institutional Access

AUM

Private wealth channels + Qualified investors + International funds

Tokenize your ETF with AndrA unlock liquidity, expand investor access, and bring your fund onto a secure, compliant digital infrastructure built for the future of finance.

Digital Share Classes

(₿)

Fractional ownership + Global distribution + Direct global investor access

We tokenize your assets and build your digital platform expanding investor access, increasing liquidity, and giving your business a modern, secure blockchain-powered foundation.

Authorized Participant Flows

$ROI

Real-time creation + Real-time redemptionLorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Full-service tokenization and platform setup your assets transformed into secure digital products, complete with a modern investor portal, compliance workflows, and global accessibility.

Bank-Grade Controls

Security is foundational to the Andra platform.

- Private domain architecture

- Fully permissioned environment

- Separation of roles

- Immutable audit logs

- Zero-knowledge interactions

- Deterministic execution

- SOC-compliant infrastructure

- Institutional KYC/KYB providers

Every action is fully traceable, auditable, and compliant.

Security

Bank-grade controls ensure every action is private, permissioned, and fully compliant end-to-end. No transfers without validated KYC/AML

Privacy

Zero-knowledge interactions and isolated domains keep sensitive data protected at all times.

Integrity

Immutable audit logs and deterministic execution guarantee tamper-proof records and predictable outcomes.

Trust

Institutional KYC/KYB, SOC-compliant infrastructure, and full traceability deliver true regulatory confidence.

Architecture & Integration

The foundation that powers secure, compliant, end-to-end tokenization for assets and ETFs.

"How the Platform Works

Andra integrates on-chain logic with existing ETF structures to deliver a compliant digital share class.

At a high level:

- ETF shares are held in a regulated trust (standard ETF custody)

- A smart contract issues a digital share class representing fractionalized ownership interests

- Compliance rules are embedded

(jurisdiction, KYC, AML, transfer restrictions) - Investors onboard to the issuer’s digital portal

(white-label, branded) - Authorized participants create/redeem positions

with real-time settlement - NAV data is synchronized

across the issuer and custodian environments

This design ensures full regulatory alignment while enabling modern distribution.”

Rali Perduhova

Founder AndrA

Enterprise Integration Support

Andra combines:

- Core team from 7RCC

- Strategic development from Cleveprine

- Integrations with top custodians and broker-dealers

- Partnerships with institutional KYC providers

Our team guides each issuer through regulatory design, technical onboarding, and go-to-market execution.

Andrei Bucsko

Co-Founder AndrA

Latest from the blog

Read up on the latest from the Blogchain.